Guides: Payroll Generation

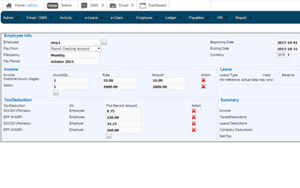

Automatic calculate EPF, SOCSO, EIS, and PCB

Automatic calculate EPF, SOCSO, EIS, and PCB contribution based on government legislation.

Monthly Payroll Report

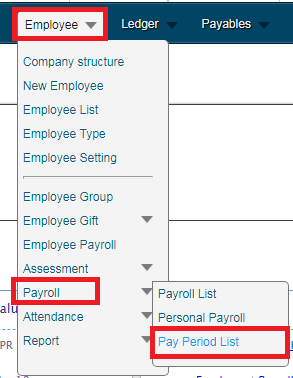

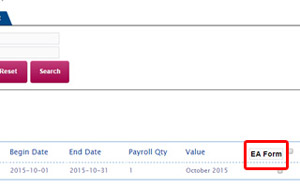

View generated company monthly payroll via Employee > Payroll > Pay Period List.

View all or search employee’s payroll list from Employee > Payroll > Payroll List.

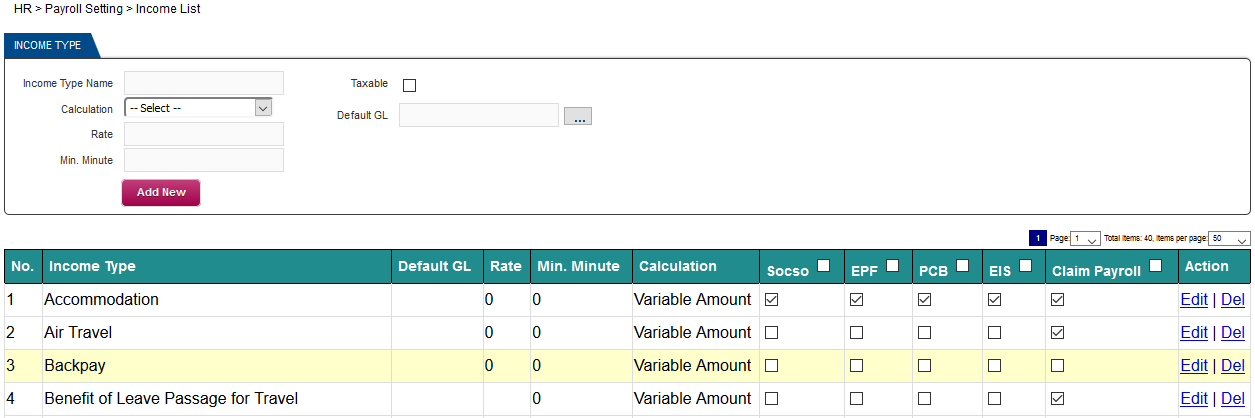

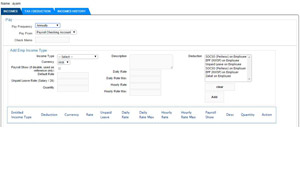

Income List

How to set my Backpay to contribute to EPF, Socso, EIS, and PCB?

Go to HR > Payroll Setting > Income List.

Individual Employee Setup

How to add the EIS / SIP to Individual Employee?

Go to Employee > Employee List.

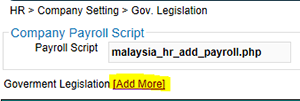

Insert Legislation Tables

How to insert new EPF, Socso, EIS / SIP tables?

Go to HR > Company Setting > Gov. Legislation.

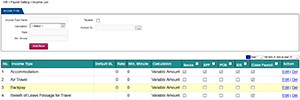

Tax Deduction List

How to add EIS / SIP Employee portion in Deduction / Tax for Payroll calculation?

Go to HR > Payroll Setting > Tax / Deduction List.

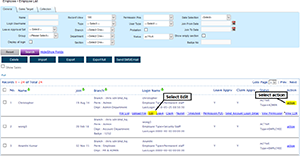

Define Income

Define employee income type (salary, monthly allowance, overtime hours, and so on) under Employee > Employee Payroll > Income option (“Action” column) to be displayed on your employee’s income list.

Payroll show: Checked income type will be displayed on employee payslip

Deduction: Select deduction type for taxable income (e.g. Salary). Hold the “Ctrl” key for multiple selections.