e-Leave HRM Payroll system enables authorized personnel from your company to create payroll computation based on your company’s rules.

Our payroll computation is compliant to the requirement of our Malaysian Labour Law in calculating the deduction of Unpaid Leave based on the number of days in the payroll cycle to decide the amount used for the deduction.

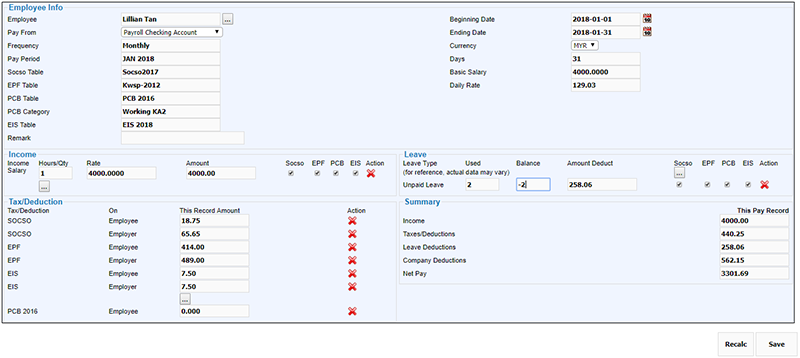

From the payroll software computation, you can view that all statutory contributions from the employee and employer are listed based on the latest table from the statutory bodies.

Deduction of KWSP, Perkeso, SIP/EIS, and Income Tax are done based on the requirements of the companies.

There are 6 portions of the payroll computation to ensure that all calculations are correctly done namely Employee Info, Payroll Cycle, Income, Leave, Tax/Deductions, and Payroll Summary.

Payslip Elements

- Employee Info

- Payroll Cycle

- Income

- Leave

- Tax / Deduction

- Payroll Summary

- Total Income

- Employee Taxes/Statutory Contributions

- Employee Leave Deductions

- Company Statutory Contributions

- Net Salary

Re-Calculate Function

If there are any alterations on the data from the system, the payroll personnel can click the Recalc button so that the payroll for that employee can be re-calculated based on the changes.

Payslip

Our e-Leave HRM Payroll system, allow all employees to view their payslip once it has been created. The employee can choose to print it out a hard copy for their safekeeping.

Submission Of Statutory Contribution

e-Leave HRM Payroll system is automated with statutory contribution calculation. We comply with the Malaysian Labour Law requirement covering KWSP, Perkeso, SIP/EIS, and Income Tax. We allow our customers to select which allowances that are paid to the employees are affected by these statutory contributions.

These statutory contributions can be exported or printed in their normal hard copy for safekeeping while payment to these statutory bodies is made through online payment via each of their webpages for KWSP, Perkeso, SIP/EIS payment, and Income Tax.

Payment of the employee salary is also made easy as it is made through the company bank account.