Tax Deduction List

[one_half]

[/one_half]

[one_half]

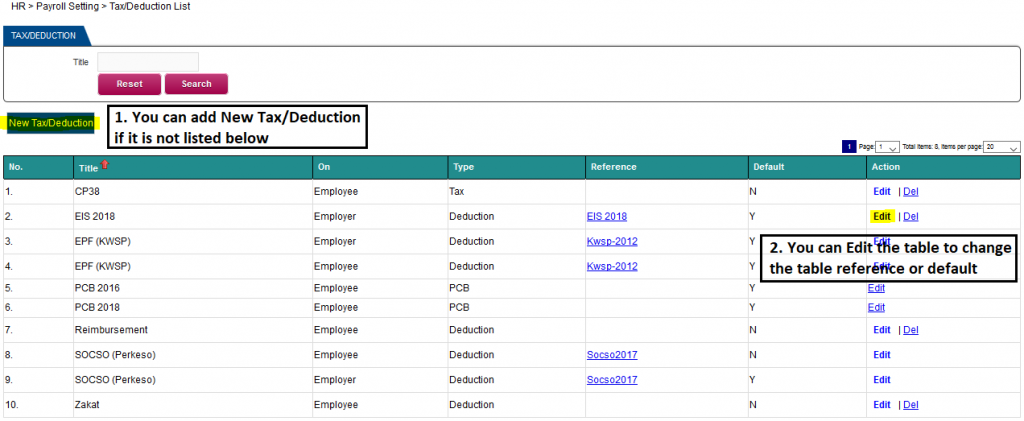

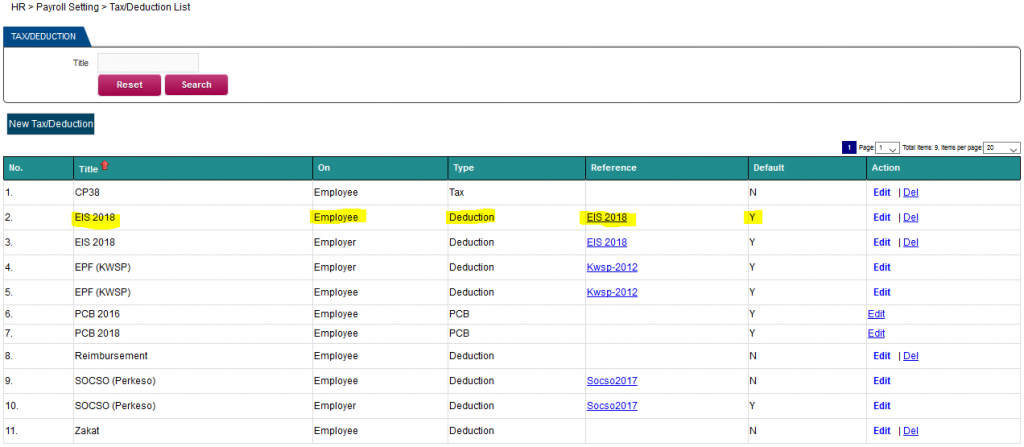

Navigate to HR > Payroll Setting > Tax / Deduction List

- You can add EIS / SIP Employee portion by using the “New Tax / Deduction” button because it is not listed.

- Click the button “New Tax / Deduction” as highlighted above.

[/one_half]

[one_half]

[/one_half]

[one_half]

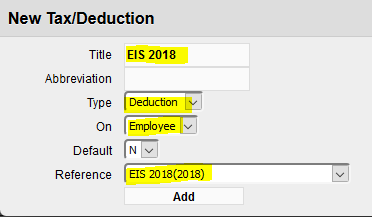

- New Tax / Deduction

- Keyin the Title: EIS 2018

- Select Type: Deduction from the drop down

- Select On: Employee from the drop down

- Select Default: N from the drop down

- Select Reference: EIS 2018(2018) from the drop down and click the Add button.

[/one_half]

[one_half]

[/one_half]

[one_half]

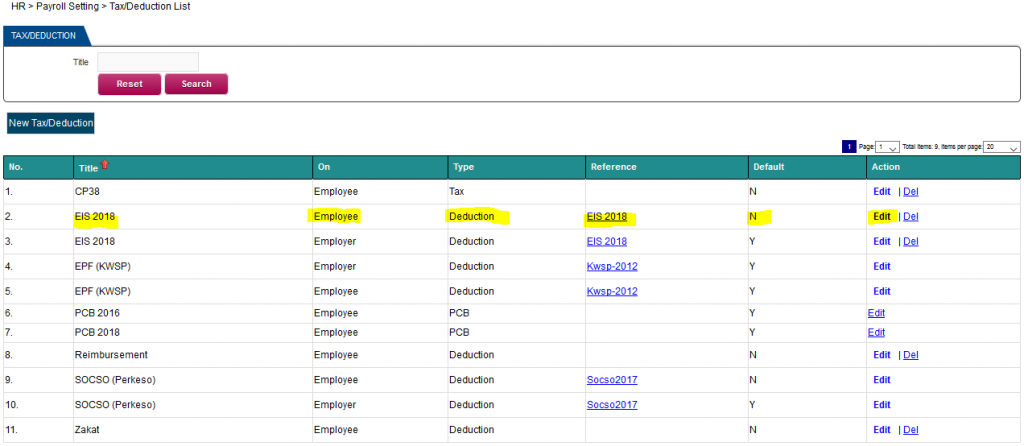

- The EIS/SIP deduction for the employee has been added in the list above (see highlighted)

[/one_half]

[one_half]

[/one_half]

[one_half]

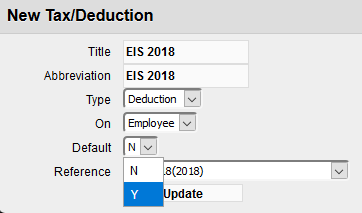

- How to change the default to Yes for the EIS/SIP Tax Deduction for the employee?

Select the above record and click the Edit word and the record will drop down. You can change the Default (selecting Yes) and click the Update button.

[/one_half]

[one_half]

[/one_half]

[one_half]

- If the Default is set to Yes, this table reference will be used for calculating the EIS / SIP for the employee.

[/one_half]